tax saving tips for high income earners uk

Or click the button below to register your interest in a free tax return quote. Do you earn a lot of money.

How Can 7 Figure Income Earners Save On Income Taxes Quora

Specifically contribute to a traditional 401 or IRA.

. Since AEF is a public charity contributions immediately qualify for maximum income tax benefits. 9 Ways for High Earners to Reduce Taxable Income 2022 1. There are four initial ways that high income earners could benefit from using a donor advised fund DAF to lessen their tax burden.

Best Ways to Reduce Taxes for High Income Earners. Register your interest today for a tax return quote. Another one of the best tax reduction strategies for high-income earners is to contribute to a retirement account.

Start a conversation on our Live Chat if you have questions on this or other tax return topics. On account of an ordinary retirement account when you put cash into it you will get charge conclusions. Employer-based accounts such as 401 k and 403 b accounts allow you.

One of best ways for high earners to save on taxes is to establish and fund retirement accounts. Your Personal Allowance goes down by 1 for every 2 that your adjusted net income is above 100000. Tax Strategies Savings for High-Income Families.

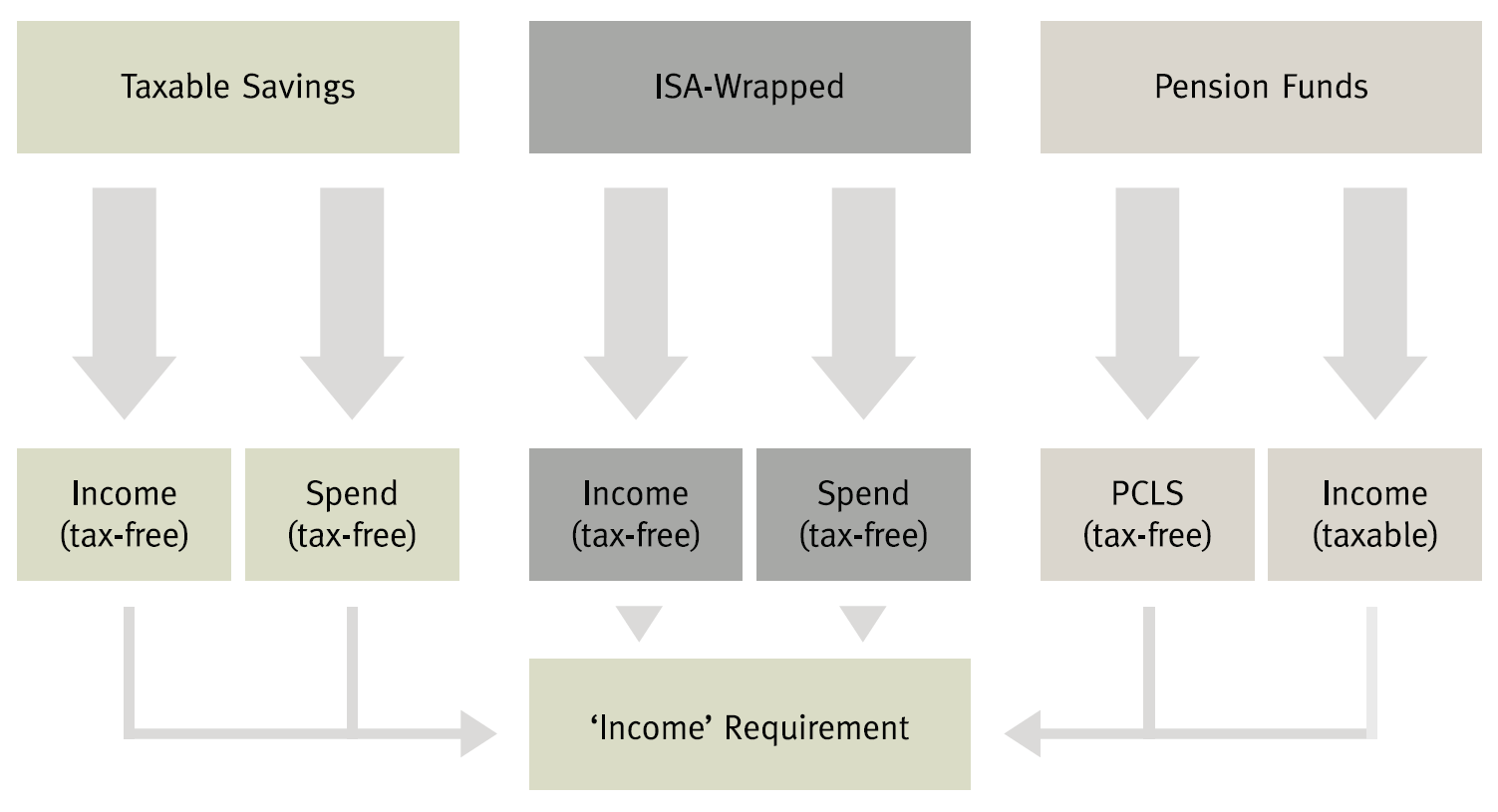

This increased tax burden for high earners is a deliberate policy by the Government which stated. Stash money in your 401 k Less taxable income means less tax and 401 ks are a popular way to reduce tax bills. They are very flexible and allow you to access your money at any time and all of the proceeds taken are free from tax on capital gains dividend income and interest.

Tax Tips for High Income Earners. However there is another tax that we must finally consider and that is Land Tax. These retirement accounts use pre-tax money so you can deduct your contributions from your taxable income.

You make contributions with after-tax dollars but the money can grow tax-free and withdrawals up to the amount of premiums paid are not taxed. Max Out Your Retirement Contributions. You receive an immediate income tax deduction in the year you contribute to your DAF.

The contribution you will make will come straight out of your. You can deduct the amount you. This means your allowance is zero if your income is 125140 or.

As the property is held in a Family trust there is no tax-free threshold so 16 of the land value is charged. This is one of the most popular tax deferral strategies for high-income earners because of higher limits that can be invested. The IRS doesnt tax what you.

Lets start with retirement accounts. Last week I wrote a blog post about how the needs of high-income earners are very similar to the needs of the rest of the population and in. Get FREE access to my E-BOOK 3 TRAINING VIDEOS with vital tax saving tips.

As a clear result of the governments. Here are 50 tax strategies that can be employed to reduce taxes for high income earners. 50 Best Ways to Reduce Taxes for High Income Earners.

If your 401k plan allows after-tax contributions then as a high income earner you have a tremendous opportunity. Max Out Your Retirement Account. Hopefully these tax-saving tips for high-income earners will help them realize the power of a home-based business.

Here are five tax saving tips that are easy to apply. A Roth IRA is a kind of retirement account that develops tax-exempt. Individual Savings Accounts ISAs One of the most straightforward ways to invest tax-efficiently in the UK is to invest within a Stocks Shares ISA.

If you are an employee and you have an employer-sponsored 401k or 403b in 2018 you can contribute up to 18500 per year of your gross income. As tax allowances are progressively withdrawn on any income over 100000 there is also a marginal effective rate of c60 that applies to any income between 100000 and 125000 regardless of where you reside in the UK. He earned a Juris Doctorate from the University of Kentucky College of Law.

But with big money can come big taxes. Its extremely difficult to get ahead in. Typically a high income earner will maximize their yearly pre-tax 401k contributions 18000 or 24000 but if after-tax contributions are allowed then up to an additional 36000 can be contributed.

Fortunately there are many ways high earners can reduce the taxes on their income. This is a net saving in tax of 105466 over the 5 years. Sell Inherited Real Estate.

529 Ira Roth Ira Hierarchy For Tax Savings Michael Kitces Financial Planning Savings Strategy Financial Planning Hierarchy

The High Income Child Benefit Charge Low Incomes Tax Reform Group

Ceci Marshall Finance Mentor On Instagram Follow Financesreimagined For More Finances And Wealth Building Tips As I P Roth Ira Finance Wealth Building

Best Tax Saving Tips Best Ways To Save Income Tax For Fy 2020 21 Abc Of Money

7 Roth Ira Advantages In Saving For Retirement Inside Your Ira Many Americans See A Roth Ira As A G Roth Ira Saving For Retirement Investing For Retirement

How To Do Backdoor Roth Ira Roth Ira Roth Ira Contributions Finance

Best Tax Saving Tips Best Ways To Save Income Tax For Fy 2020 21 Abc Of Money

Year End Tax Planning For Individuals Saffery Champness

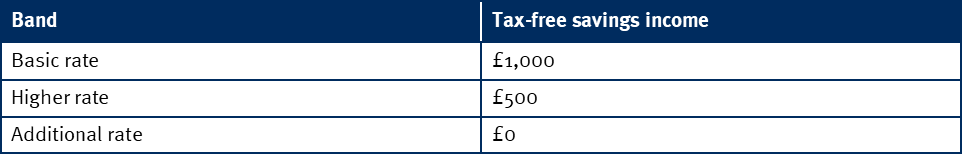

Tax Free Savings Check If You Re Eligible Money Saving Expert

The 5 Years Before You Retire Retirement Planning When You Need It The Most Paperback Overstock Com Personal Finance Books Retirement Planning How To Plan

A College Savings Debate The White Coat Investor Investing And Personal Finance For Doctors White Coat Investor Investing Books Investing

What Tax Do I Pay On Savings And Dividend Income Low Incomes Tax Reform Group

Quick Tips For Tax Payers To Save Tax This Season The Financial Express

Free Childcare In Scotland How To Guide Childcare Childcare Costs Early Learning

High Income Earners Fail To Appreciate The Math Of 529 Plans Part Ii Resource Planning Group 529 Plan Saving For College Retirement Savings Plan

How Did You Save Your Tax Money This Year If You Are In A 30 Slab Quora